Who gets to belong to a group? A fence and a campfire are two ways of thinking about membership. The problem is they disagree, and neither considers itself wrong. The FenceOne way to define membership is by building a fence. Draw a line, a perimeter. People inside it are members, people outside aren’t. Credentials, certifications, cultural markers, or admission fees determine who gets in. This is how professional licensing works. To practice medicine, you need a medical degree, a passed board exam, and state certification. It doesn’t matter how much you know or how many successful procedures you’ve informally performed; without the credential, you’re not supposed to practice. And even if you earned all three qualifications in another country, you still might not be permitted to call yourself a doctor in this one. The same logic shows up everywhere, at every scale. You’ll never sit with the cool kids in high school if you dress like a geek. To participate in class discussion, you raise your hand. Arrive at a formal dinner without an invitation and you’ll be asked to leave. Some religions work the same way; no baptism, no confirmation, no membership. You’re either in the Kingdom of Heaven or you’re out, crying and gnashing your teeth. Contemporary immigration policy is the starkest version of all this. A nation draws legal boundaries around citizenship, and those boundaries don’t bend easily for lived experience. An immigrant might raise children, pay taxes, and contribute to civic life for thirty years, and the fence will still say no. Every fence has two sides, but the people who build them are usually only thinking about one: keeping the wrong people out. What they don’t account for are the good things it also keeps out, the new perspectives that never arrive, the ideas that might have solved problems no one inside could crack, the humbling reminder that yours is not the only right way. A profession that credentials its members gains consistency and protection, but it also grows insular. The longer a fence stands, the more what’s inside it starts to look like the only way things could ever be. The CampfireThe second way to define group membership doesn’t use a fence; it’s about shared interest and orientation. Picture people gathered around a campfire. Those oriented around the fire are in the same group, tuning into the same frequency. These are communities of practice: groups that form around shared work, shared learning, or shared purpose. Open-source software communities work this way. Nobody certifies you as a member. You become a member by contributing code, joining discussions, learning how the community does things. A self-taught programmer who submits patches belongs; a computer science PhD who doesn’t contribute doesn’t. The center is the shared work. You belong by sharing in it. Similarly, you’re in on an inside joke the moment you get it. Nobody certifies you as a Swiftie; you belong the moment you love the music of Taylor Swift. The only requirement to belong to Alcoholics Anonymous is a desire to stop drinking, you could be stinking drunk when you go, as long as you wish you weren’t. Nobody admits you to these groups, you admit yourself. With a campfire, you can choose the extent you want to be involved. You belong to the circle by toasting marshmallows, or watching those who do; by singing songs, or just listening; by being close enough to singe your shoes, or so far that you see the light without feeling the heat. It’s possible to be partly tuned in and still be tuned in. There’s no place anyone can draw a line. Which is Better? The Fence or the Campfire?Neither system is inherently superior; each serves different purposes. A fence is what you need when you’re collecting dues, certifying safety, keeping secrets, or defending hard-won prerogatives. A campfire is what you need when you want people who actually care. Many groups use both, which is where the trouble starts. Universities build fences with their admissions requirements, course requirements, and the limits of academic disciplines; but the best learning happens in informal bull sessions, debating after class over beers, comparing lab results with colleagues, or crossing disciplines. When you put up no barriers against them, the best people can get in. You get the most passionate and effective involvement in a group where the only requirement is tuning in. Many groups form when people spontaneously gather around a shared purpose, only to make it formal by putting up a fence later. Families are formed this way. When two people fall in love, they’re forming a group of two by tuning in to each other. Later, they make it official by co-signing a lease, getting married, or making some other kind of promise. Then they’re building a fence, in this case, to both fence in and fence out. If the couple have children, the kids are admitted by blood; although exceptions can be made through foster care arrangements or formal adoption. There may still be people outside the fence, watching the campfire within, like close friends; but because they’re not blood, they can’t get in to toast marshmallows. When the Fence Comes LateSerious conflicts about belonging happen when someone tries to build a fence to define a group that has gathered around a campfire. My own profession is an example. I began my career as a psychotherapist before there were licensing requirements. You could be a therapist just by calling yourself a therapist and someone hiring you to be one. All you needed was an absorbing interest in the psychological workings of other people. If you were insightful enough, people would come to you for advice. If they were happy, they’d come back and tell their friends. Some of us therapists got a lot of education anyway, but it was because of that absorbing interest, not because someone told us we had to have it. Then around 2000, the New York State Legislature wrote laws to licence us. These were designed to protect the consumer from uneducated therapists and give them a way of kicking the bad ones out. It also gave us a way to protect the investment we made in our education from competitors who didn’t make that investment. I welcomed it when it came; it gave us dignity and recognition. But the State made the educational requirements so rigid, I was lucky that the law had a provision that temporarily grandfathered in people like me who already practiced the profession. If I had to apply now, even after advanced degrees and thousands of people putting their trust in me for forty years, I would be fenced out. In fact, I may choose to give up my license when it expires in 2027 because the continuing educational requirements are so inflexible. Even though I live for continuing education, unless I take the approved courses all over again, I will not meet their requirements. I’m far from the only one who is fenced out of a group to which they belong by virtue of the campfire. The pattern repeats in almost every creative and intellectual field. In most universities, you cannot teach your subject at the college level without a PhD, regardless of what you know or what you’ve done. Take David McCullough, for instance. He won two Pulitzer Prizes for history, wrote books that defined how Americans understand John Adams, Harry Truman, 1776, the western pioneers, the Wright Brothers, the Panama Canal, and the Brooklyn Bridge, but he has no PhD. Consequently, most colleges would not hire him to teach history. A PhD in history certifies how you came to know it, not what you know about it. If you came to know it the wrong way, there’s no getting through the fence. The people inside it will read your books, cite your work, and teach your methods; they just won’t let you in the room. When You’re on the Wrong Side of a FenceWhen someone fences you out of your campfire, you have five basic options: defer, earn, push, wait, or circumvent. Defer: Most people, most of the time, don’t storm fences or look for gaps in them. They see a boundary, assume it’s there for a reason, and adjust their behavior accordingly. This is not weakness; it’s how societies function. You don’t walk into a restaurant kitchen, lay down on the couch in a stranger’s home uninvited, or submit your article to a journal that publishes only credentialed researchers. You recognize the fence and route around it without being asked. The problem is that this same instinct, so useful in most situations, quietly closes doors that were never locked. For instance, the kid who stops raising their hand after saying something wrong in class and the writer who never submits because rejection would make the failure official. Deference feels like good manners; sometimes it is. But fence builders count on it, because a fence that people respect without question is far cheaper to maintain than one you have to actually enforce. Earn: The most straightforward response when you want to get in is to meet the gatekeeper’s requirements. Get the credential, pay your dues, pass the exam, put in the years. This is what the fence was designed to encourage, and it works, assuming the requirements are achievable and the fence is operated in good faith. When they are, earning is the cleanest solution; you come out the other side with the membership and the legitimacy that goes with it. There’s another way past the gate that doesn’t require earning the usual way. It’s the way that ushers get to watch the show. They don’t pay the admission fee, they make themselves useful. Suppliers, translators, fixers, critics, and consultants all occupy this position. They never get a membership card, but they’re at every meeting anyway; their calls get returned, their opinions get solicited, their invoices get paid. The fence is still there, but it has stopped mattering in any practical sense because the people inside it need you to function. Push: You don’t even acknowledge a fence or you test its strength. Often, pushing triggers resistance, the group closes ranks, you end up more excluded than before, and now everyone knows you tried and failed. But many fences give way if the people who patrol them lack the authority to enforce their limits. Pushing has subtler variations. You can infiltrate: get in by disguise or by finding a gap in the fence. Some women entered male-dominated professions this way, by adopting the dress, manner, and speech of men. You can appeal to others for help: challenge the legitimacy of the fence itself through courts, public opinion, or moral argument. The civil rights movement was, among other things, a sustained appeal to lawmakers against the fences of Jim Crow. Or you can befriend the bouncer: cultivate someone who controls access rather than trying to earn membership from the group as a whole. A bribe, a well-placed mentor, a sponsor in a closed industry, or a well-timed introduction can work, but they depend entirely on finding the right person and making it worth their while. Wait: You park yourself at the threshold until they let you in. You’ll have to tolerate uncertainty for a long time, while being visible and vulnerable, neither in nor out, hoping. Sometimes it works. Sometimes you outlast the fence. Gatekeepers retire, fashions change, institutions collapse, and suddenly the credential that excluded you no longer exists or no longer matters. Gay people were once excluded from marriage until the laws and customs changed. Now they can all get married, even if they were never activists, pushing to be let in. Circumvent: If they won’t let you into their party, throw your own party. Create a new group outside the fence, defined by the same shared interest. When licensing requirements are too rigid for some therapists, many call themselves coaches. When publishers ignore certain writers, they self publish. Once you throw your own party, two more moves become available. You can poach: draw people away from the original group until it hollows out, which is what independent podcasters have done to legacy radio. Or you can reframe: argue that your group is the authentic one and theirs is the imitation. Punk made exactly this argument against arena rock. Protestant reformers made it against the Catholic Church. Open-source developers made it against proprietary software. The reframe doesn’t just start a rival party; it contests the legitimacy of the original group. Most people default to one or two of these choices across situations, so they become a habit. I make a good living as a therapist by helping people identify overused methods and encouraging them to try something else. I’ve worked with a lot of folks who flee at the glimpse of a fence, vanishing before anyone can say no. There’s also a lot of chronic pushers who demand inclusion everywhere, as well as tireless earners who never stop proving themselves, even after the goalposts are moved on them. My personal favorite is circumvention; I tune into whatever I want, heedless of fences, even when I might have been admitted, had I applied. The more useful approach would be to diagnose which choice fits which situation; because the wrong move, made mindlessly, often gets you more firmly excluded. Cultural AppropriationAfrican-American musical genres of jazz, rock and roll, the blues, funk, and rap began as the purest possible expression of the campfire. There were no gatekeepers to these musical genres; if you loved the music, it was yours. The communities that created these forms happened to be largely African-American, but they were defined entirely by shared attention, with no fence limiting who could participate. When white musicians gathered around that campfire, they did it with genuine devotion, sitting with the originators, learning the music on its own terms, absorbing it until it became something that had become part of them. African-American music spoke to Jewish musicians and poor whites in particular because, while their skin was not black, their experience of exclusion from society was similar. But when white musicians began to perform and record and profit, the African-American community put fences up. You couldn’t be an authentic jazz, rock and roll, blues, or hip hop artist if you weren’t Black. By this logic, no amount of sitting around the campfire, or personal suffering, could get a white musician through the gate. They were fenced out not by how well they played, what they experienced, or how hard they had listened, but solely by the color of their skin. Those white musicians, and their defenders, had the standard responses to being fenced out. Many deferred and kept to their own traditions of klezmer and bluegrass. Some pushed, arguing that the fence was arbitrary, that devotion and craft were the only legitimate membership requirements. Some earned, by technical virtuosity. Others became genuinely useful by working alongside musicians from the originating community or supporting causes connected to them. Some circumvented and went on playing the same music, by calling it rockabilly instead of blues, disco instead of funk, and trap instead of rap. In the end, fencing white musicians out simply could never work. A fence around a musical tradition has no posts and no wire; it runs only through the willingness of people to honor it, and the people most eager to cross it were under no obligation to honor anything. It violates the most fundamental feature of musicianship, to be influenced by what you hear. The African-American community could declare the fence, but it had no way to enforce it. A fence can’t stop people who don’t recognize its legitimacy from walking straight through it. Sometimes all it does is piss people off. But there was another fence involved, one that had more to do with money than music. Black musicians couldn’t play the same venues, negotiate the same record deals, or reach the same radio stations. The commercial infrastructure that would reward the blues for being the blues was legally and commercially closed to many of the people who created it. So when white artists carried black music to mainstream audiences, they passed through a door that had been locked against the ones they learned it from. From this perspective, the question was never whether white musicians had tuned in sincerely; it was that sincere appreciation of the music and commercial access were available to them simultaneously, while the people who created the tradition had been fenced out of one even as they remained inside the other. The responses from Black musical communities followed the same taxonomy, but the target was different. Most deferred and never attempted to play to a larger audience. Pushing took the form of legal action; artists like Little Richard and Chuck Berry fought for songwriting credits and royalties that had been taken from them, sometimes successfully, more often not. Waiting meant persisting till the fence around the commercial infrastructure would eventually come down. Earning meant some exceptional musicians were accepted. Many mentors of white artists became genuinely useful. And circumvention, the most consequential response, meant building entirely new campfires. Bebop was a deliberate act of circumvention; music harmonically dense, rhythmically complex, and technically demanding so that casual appropriation was harder. It also created new institutions: independent record labels, club circuits, and critical vocabularies that Black musicians controlled. Funk and hip hop repeated this pattern in different eras and different ways; not just as artistic innovation but as a recurring attempt to build a fence around something new before the old sequence could repeat itself. Each time, the fence was porous; the music traveled anyway. And each time, the argument about who belonged, and who had the right to profit, started again. ConclusionSo here we are, back where we started: wanting to belong, and fighting over what the word even means. The fence and the campfire serve different purposes, answer different questions, and produce different kinds of community; and because they measure membership differently, they will keep producing different verdicts about who’s in and who’s out. We can see the fight more clearly when it starts. Most arguments about belonging are not really arguments about whether someone deserves to be included; they’re arguments about which system should be doing the measuring. The credentialed historian and the popular writer aren’t disagreeing about history, so much as they’re disagreeing about whether history is a fence or a campfire. The licensing board and the experienced practitioner aren’t disagreeing about competence; they’re disagreeing about whether competence is something you can certify. The argument about cultural appropriation isn’t really about music; it’s about which fence was there first, whose fence it was, and who was already on the wrong side when the music started. Neither system is going away. People will keep building fences because fences do real work, and people will gather around the campfire because the joy of involvement doesn’t need credentials. The collision between them is not a problem to be solved. It is a condition of belonging itself. For Further ReadingThe academic sources behind this piece are Michèle Lamont’s Cultivating Differences (1992) and Etienne Wenger’s Communities of Practice (1998), but neither is written for a general audience. Here are books that are. On belonging and exclusion Richard Sennett, The Fall of Public Man (1977). Sennett examines how modern life eroded the shared public spaces where belonging once formed without credentials or gatekeepers. Tara Westover, Educated (2018). A memoir that is, among other things, a precise account of what it costs to earn your way through a fence, and what you leave behind when you do. On communities of practice and how knowledge actually travels Michael Polanyi, The Tacit Dimension (1966). Short and accessible; the best account of why so much of what makes someone belong to a tradition cannot be written down in a credential. Matthew Crawford, Shop Class as Soulcraft (2009). Crawford, a philosopher who left a think tank to open a motorcycle repair shop, makes the case for knowledge that fences cannot certify and cannot contain. On cultural appropriation and American music Elijah Wald, How the Beatles Destroyed Rock ‘n’ Roll (2009). A music historian’s account of how American popular music has always traveled across racial and cultural lines, and what gets lost and gained each time it does. The title is deliberately provocative; the argument is scrupulous. Ted Gioia, The History of Jazz (1997). The clearest single-volume account of how a tradition built by one community became, repeatedly and controversially, everyone’s. Nelson George, The Death of Rhythm and Blues (1988). George makes the commercial fence argument with precision and without sentimentality; essential for understanding what Black musical communities were actually responding to. On credentials and who they serve Randall Collins, The Credential Society (1979). Collins argues that educational credentials function primarily as social fences rather than as measures of competence. Academic in origin but readable; the central argument has only become more relevant. You're currently a free subscriber to The Reflective Eclectic. For the full experience, upgrade your subscription. |

RelationDigest

Monday, 9 March 2026

Two Ways to Belong

Greater Israel Forces a Chaotic Realignment of Global Systems

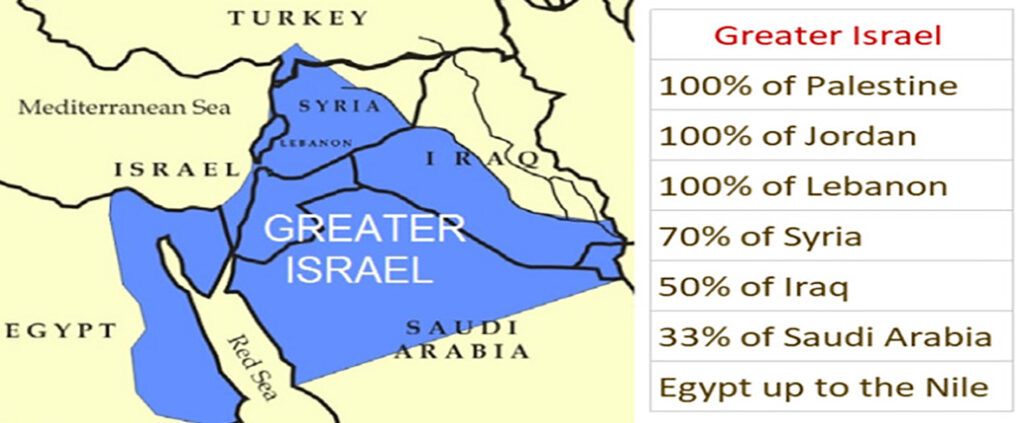

In 1996, a nest of American-born imperialists revolving around Paul Wolfowitz, Dick Cheney, Donald Rumsfeld, and Richard Perle created a new think tank called “The Project for a New American Century.” While the principled aim of the think tank ultimately hinged on a new “Pearl Harbor moment” that would justify a new era of regime-change wars in the Middle East, a secondary but equally important part of the formula involved the dominance of “Greater Israel” Likud fanatics then taking power over the murdered body of Yitzhak Rabin. It was toward the start of the new regime of Prime Minister Benjamin Netanyahu that Richard Perle wrote the report “Clean Break: A Strategy for Securing the Realm,” which outlined a series of goals that would govern the strategic vision of Washington and Tel Aviv for the next two decades. It called for:

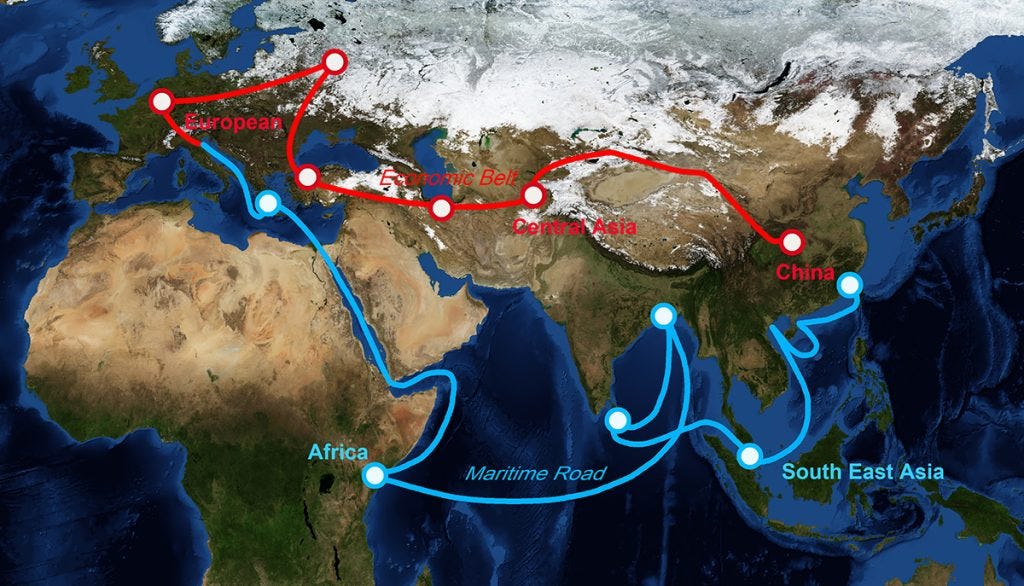

In 2007, General Wesley Clark added even more detail to this neocon program when he revealed the content of a discussion he had with Wolfowitz and Rumsfeld 10 days after 9/11. General Clark stated that he was told of planned invasions of seven countries scheduled to take place within five years… namely: “Iraq, Syria, Lebanon, Libya, Somalia, Sudan, and Iran.”  This program was, in short, a recipe for establishing the long-awaited “Greater Israel” promoted by the likes of Theodor Herzl, Vladimir Jabotinsky, and Rabbi Abraham Isaac Kook over a century ago. While the Anglo-Zionist timeline was disrupted over the ensuing years (sometimes involving brave intervention by individuals within America’s intelligence community), the intention embedded in “Clean Break” never disappeared. With the coming breakdown of the over-inflated Western financial system on one side and the emergence of a viable new multipolar security and economic architecture on the other side, it appears the ghouls that orchestrated 9/11, assassinated Rabin (1995) and Arafat (2004), and revived the Crusades have decided to kick over the chess board. Conducting a rational analysis of the motives for this type of dynamic poses a major difficulty for any geopolitical commentator used to thinking in academically acceptable terms, which presume that rational self-interest animates the players within a game. In this case, rational self-interest is infected by heavy doses of self-delusional Hegemonism, fanatical imperial zealotry, and end-times eschatology with a Messianic twist (taking both Christian and Jewish forms). Sifting out Order from ChaosNetanyahu and his supporters in America and Britain appear to be supportive of Israel’s ambition to provoke a vast regional war, on the one hand, while also believing that perhaps they will be able to use Israel as a wedge to disrupt Russian and Chinese-led development corridors (BRI, short for Belt and Road Initiative, and International North–South Transport Corridor), on the other hand. These Eurasian development corridors are rightfully seen as an existential threat to Western imperialists as they provide the foundation for the viability of a new economic architecture based on long-term thinking and mutual cooperation. The role Israel is expected to play in an anti-BRI agenda is meant to take the form of two major projects within this ivory tower fantasy game of imperial Rand-style scenario builders. These are:

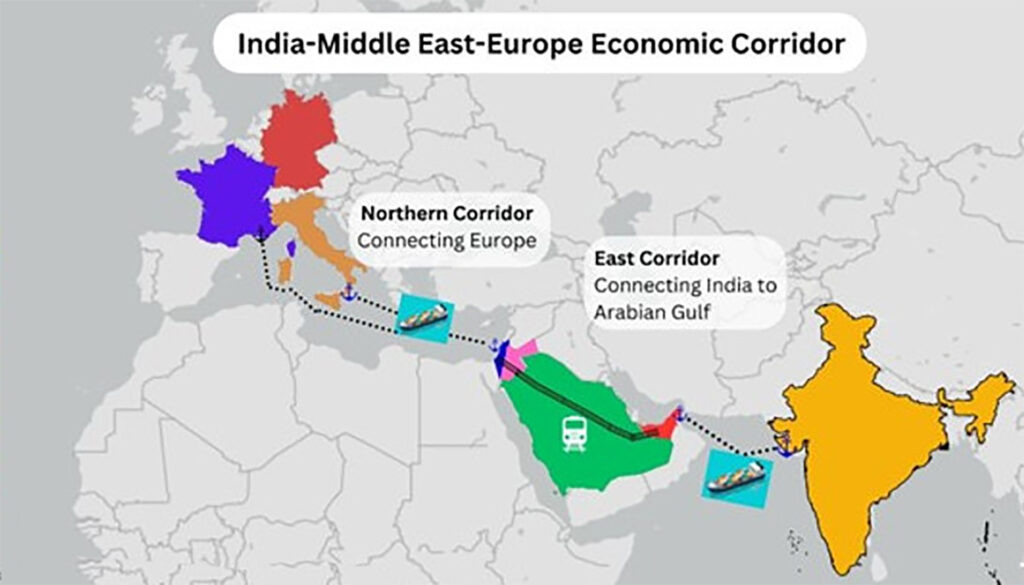

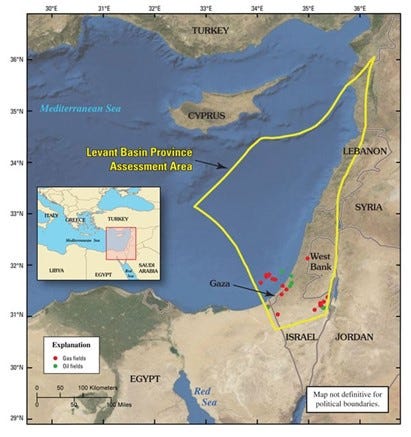

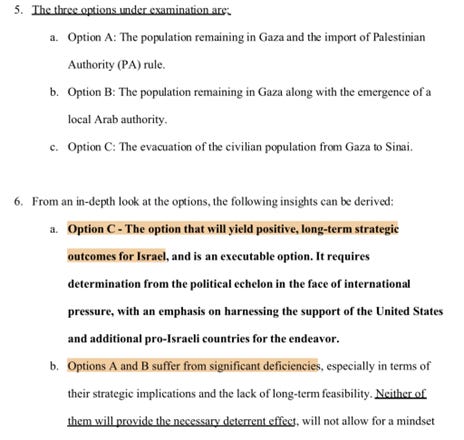

The IMEEC FantasyThe India Middle East Europe Economic Corridor appeared to be a non-starter since it was first announced over two years ago. However, with the potential radical destabilization of the broader Middle East that may emerge out of a war on Iran, it is possible that this project has been given a new life and may represent a dangerous alternative to the Chinese-led Belt and Road Initiative. Is Narendra Modi more committed to Eurasian prosperity, or is he being pulled into this dangerous alliance? While India plays a strategically important role as a leading member of the BRICS, the Shanghai Cooperation Organization, and a vital ally of Russia, the western–IMEEC pull is as dangerous as it is real. With Modi’s recent two-day state visit to Israel as a guest of honor from February 25 to 27, the Indian leader re-asserted his belief in the importance of the IMEEC, as well as the I2U2, stating: “We will also work closely in different formats, such as the India–Middle East–Europe Economic Corridor and the I2U2 frameworks between India, Israel, UAE and the US.” he I2U2 was first announced in 2022 and has been compared to Middle East QUAD that would counter the influence of Iran and would parallel a similar power block forming in the Pacific under a US–India–Japan–Australian alliance to counter China. During his talks with Netanyahu, Modi re-asserted his support for the Abraham Accords and gave his full support to Israel in opposition to Palestinian terrorists, stating: “Like you, we have a consistent and uncompromising policy of zero tolerance for terrorism with no double standards” and that “India stands with Israel, firmly, with full conviction, in this moment, and beyond.” During the meeting, Netanyahu emphasized his plan for a Hexagon Alliance encompassing Greece, Cyprus, India, Israel and an unspecified number of Arab and African states friendly to Israel. On top of agreements for Artificial Intelligence, business exchange, critical minerals, energy, and defense, a much more comprehensive India–Israel Free Trade Deal and Strategic Partnership was also discussed. A Real Concern: Gaza Offshore Energy StealIf developed, it is believed that these offshore resources would transform Israel into a global energy hub supporting the glory of Greater Israel as a new empire. This vast deposit off the coast of Gaza (and thus under the legal ownership of the people of Gaza) was first discovered in 1999 when a company called British Gas discovered deposits of approximately one trillion cubic feet of natural gas 19 miles off the Gaza coast. Agreements to develop this project at a cost of $1.2 billion soon followed. Although Yassir Arafat expressed an active interest in developing these resources two decades ago, Israel worked tirelessly to block the Palestinian Investment Fund (the fund responsible for carrying out the development) from extending investments into the project, using the argument that “funding may be used to support terrorism.” When Hamas was elected in 2007, Israel’s efforts to block funding for the Gaza marine field vastly increased. This is perhaps why Hamas’ 2007 victory was celebrated by none other than Israeli intelligence Chief Amos Yadlin, who cabled US Ambassador Richard Jones that he would be “happy” if Hamas formed a government because “the IDF could then deal with Gaza as a hostile state.” In the cable made available by Wikileaks, Yadlin also dismissed concerns about Iranian influence within a Hamas government “as long as they [Hamas-controlled Gaza] don’t have a port.” Yadlin’s comments were echoed in 2019 by Netanyahu himself, who said to Likud Knesset members: “Anyone who wants to thwart the establishment of a Palestinian state has to support bolstering Hamas and transferring money to Hamas … This is part of our strategy — to isolate the Palestinians in Gaza from the Palestinians in the West Bank.” [emphasis added] When a consortium of Israeli, American, and Australian energy companies discovered even more oil and natural gas deposits in the Levant Basin “off the coast of Israel” in 2010–2011, the western Mediterranean became a potential global gamechanger in oil geopolitics with the US Department of the Interior 2010 report estimating “1.7 billion barrels of recoverable oil and a mean of 122 trillion cubic feet of recoverable gas in the Levantine basin.” Experts estimate that these deposits carry at least $453 billion in value. Former Israeli Energy Minister Karine Elharrar described Israel’s ambition to become a global energy hub after signing a 2022 memorandum of understanding (MOU) with Egypt promising to develop the gas fields: “This is a historical moment in which the small country of Israel becomes a significant player in the global energy market. The MOU will enable Israel, for the first time, to export Israeli natural gas to Europe, and it is even more impressive looking at the significant set of agreements we signed over the last year, which position Israel, and Israeli energy and water sectors as a key global player.” Elharrar’s words carried a bitter aftertaste as it had already been proven that Israel intentionally blocked the development of these offshore fields for two decades — to the detriment of millions of Palestinian lives (and ironically Israel’s own economy). This fact was outlined in great detail by a 2019 report by the United Nations Conference on Trade and Development (UNCTAD), which stated: “Geologists and natural resources economists have confirmed that the Occupied Palestinian Territory lies above sizeable reservoirs of oil and natural gas wealth, in Area C of the occupied West Bank and the Mediterranean coast off the Gaza Strip. However, occupation continues to prevent Palestinians from developing their energy fields so as to exploit and benefit from such assets. As such, the Palestinian people have been denied the benefits of using this natural resource to finance socioeconomic development and meet their need for energy. The accumulated losses are estimated in the billions of dollars. The longer Israel prevents Palestinians from exploiting their own oil and natural gas reserves, the greater the opportunity costs and the greater the total costs of the occupation borne by Palestinians become. This study identifies and assesses existing and potential Palestinian oil and natural gas reserves that could be exploited for the benefit of the Palestinian people, which Israel is either preventing them from exploiting or is exploiting without due regard for international law.” If Israel wishes to have full control over Gaza’s maritime oil/gas reserves, it can only achieve its goal if the legal owners and beneficiaries living in Gaza disappear. On October 13, 2023, a policy paper authored by Israel’s Ministry of Intelligence was leaked. It recommended “the forcible and permanent transfer of the Gaza Strip’s 2.2 million Palestinian residents to Egypt’s Sinai Peninsula,” as +972 reported. The paper laid out three possible scenarios for the people of Gaza. The first involves the replacement of Hamas with the Palestinian Authority in Gaza. The second involves the emergence of a new local Gaza authority (not Hamas or PA), and the third includes the expulsion of all civilians into Egypt. The report clearly identifies the third scenario as the most preferable option. The report’s authors write that this third option “will yield positive, long-term strategic outcomes for Israel, and is an executable option. It requires determination from the political echelon in the face of international pressure, with an emphasis on harnessing the support of the United States and additional pro-Israeli countries for the endeavor.” Of course, US support for moving Gazans into the Sinai Peninsula began literally minutes after October 7. This would create a serious problem for future retaliation by extremely radicalized and traumatized people whose families have been killed by Israel’s crimes for decades. Perhaps if this was still 1996, and no powerful coalition of Russia, China, and Iran existed to defend Egypt against the threatened Anglo-Zionist war, then the PNAC Clean Break: A Strategy for Securing the Realm might be possible. The decision to ignore reality by rehashing this obsolete program implies the height of incompetence, which threatens to grow far beyond a regional war and into a global thermonuclear conflagration more quickly than many imagine. This foreshadowing of a prophetic global war to usher in the Messiah (as many Christian rapturists dream of) was outlined in depth by Greater Israel advocate and Jabotinsky collaborator Rabbi Abraham Isaac Kook 100 years ago. Kook was Britain’s selection for the Chief Ashkenaz Rabbi for Jerusalem and Palestine from 1919 to 1935, and his influence in shaping several generations of radical Zionist zealots that took over control of much of Israel’s government after the inside job that was the Six Day War is immense. His prophetic remarks should not be easily dismissed. In his book Orot, Kook said: “In wars, national characters crystalize. Israel, as the universal reflection of mankind, benefits thereby. The heels of Messiah follow upon World Conflagration… At the hour of the downfall of Western civilization, Israel is called upon to fulfill its divine mission by providing the spiritual basis for a New World Order.” [emphasis added] The only hope to avoid this calamity and disrupt this flight toward an Armageddon scenario steered by End Times Messianic cultists is to force a ceasefire, as Russia, China, and the vast majority of world citizens (even Americans) demand. Without this restoration of sanity, the world as a whole will be in for an experience that will make the 14th-century Dark Age appear to be an uncomfortable hiccup in world history.

Bio: I am the editor-in-chief of The Canadian Patriot Review, Senior Fellow of the American University in Moscow and Director of the Rising Tide Foundation. I’ve written the four volume Untold History of Canada series, four volume Clash of the Two Americas series, the Revenge of the Mystery Cult Trilogy and Science Unshackled: Restoring Causality to a World in Chaos. I am also co-host of the weekly Breaking History on Badlands Media and host of Pluralia Dialogos (which airs every second Sunday at 11am ET here). This article was first published on Pluralia Follow my work on Telegram at: T.me/CanadianPatriotPress

© 2026 Rising Tide Foundation |

-

Rex Sikes posted: " Take this quote of William Atkinson Walker's to heart. Understand it and apply it in your life. ...